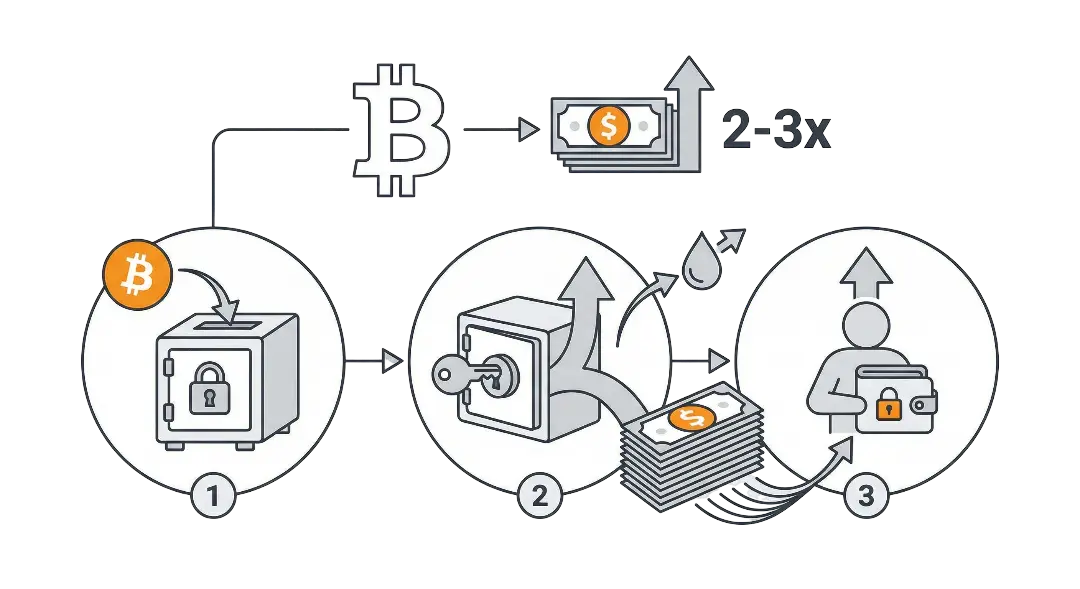

Using your Bitcoin as collateral allows you to unlock cash while still benefiting from potential price appreciation. Platforms like Ledn, Bitfinex, and Aave offer loans funded within hours using BTC collateral.[1][2][3]

How Bitcoin-Backed Loans Work

The process begins when you deposit Bitcoin into a lending platform's wallet or smart contract. The platform assesses the collateral's current market value and approves a loan amount based on their risk parameters.[4][5]

You receive funds instantly—either USD, stablecoins like USDC, or fiat—while your Bitcoin remains locked but appreciating if prices rise. Interest accrues over time as you use the borrowed capital for business expansion, real estate, or other opportunities.[3][6]

Monitoring happens continuously: the platform tracks Bitcoin's price against your loan balance. If market conditions change significantly, they may require additional collateral or partial repayment to maintain stability.[3][5]

The Repayment Process

Repayment works flexibly—you can pay down principal anytime without penalties on most platforms. Interest-only payments keep costs minimal while preserving liquidity.[1][2]

When ready, repay the loan principal plus accrued interest. Your full Bitcoin collateral returns immediately, tax-free since no sale occurred.[7]

Platform Comparison

| Platform | Funding Speed | Collateral Options | Interest Structure | Settlement Type |

|---|---|---|---|---|

| Ledn [1] | Instant | BTC only | Fixed monthly | Custodial |

| Bitfinex [2] | Minutes | BTC + alts | Variable hourly | Custodial |

| Aave [8] | Block time | Multi-asset | Algorithmic | Non-custodial |

| Debifi [2] | 24 hours | BTC | Negotiated | P2P |

| Nexo [9] | Instant | BTC + 50+ | Tiered | Custodial |

Managing the Position

Platforms provide real-time dashboards showing collateral health, interest accrual, and price alerts. Set notifications for key thresholds to stay proactive.[4][10]

Use borrowed funds strategically—business investments, property acquisition, or portfolio diversification—while Bitcoin compounds in the background.[11]

This mechanism transforms illiquid holdings into working capital without sacrificing long-term upside exposure.[5]

References

[1] Ledn - https://www.ledn.io/borrowing [2] Bitcoin Magazine - https://bitcoinmagazine.com/guides/best-bitcoin-backed-loans [3] Discovery Alert - https://discoveryalert.com.au/borrowing-against-bitcoin-holdings-2025/ [4] EarnPark - https://earnpark.com/en/posts/bitcoin-loans-explained-borrow-against-your-crypto-holdings/ [5] CoinLedger - https://coinledger.io/tools/best-companies-for-crypto-and-bitcoin-loans [6] DailyCoin - https://dailycoin.com/top-5-crypto-lending-platforms-in-2025-where-to-lend-and-borrow-smarter/ [7] CoinLedger (Tax) - https://coinledger.io/tools/best-companies-for-crypto-and-bitcoin-loans [8] DeFiPrime - https://defiprime.com/decentralized-lending [9] Nexo - https://nexo.com/zh-tw/blog/bitcoin-backed-loans [10] Galoy - https://www.galoy.io/bitcoin-backed-lending [11] Enness Global - https://www.ennessglobal.com/insights/blog/crypto-backed-loans-how-borrow-against-your-digital-assets-without-selling